US In Vitro Diagnostics Market

US In Vitro Diagnostics Market by Product & Service (Kits, Instruments), Technology (Immunoassay, Hematology, Glucose Monitoring), Specimen (Blood), Site of Testing, Application (Endocrinology, Cardiology, Infectious Diseases) - Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

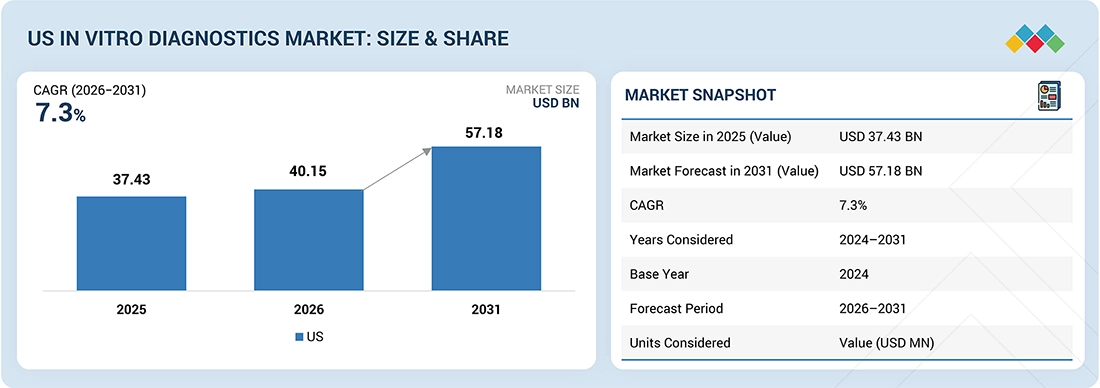

US In Vitro Diagnostics market, valued at USD 37.43 billion in 2025, stood at USD 40.15 billion in 2026 and is projected to advance at a resilient CAGR of 7.3% from 2025 to 2031, culminating in a forecasted valuation of USD 57.18 billion by the end of the period. This growth is primarily driven by the rising prevalence of chronic and infectious diseases, the increasing demand for early and accurate diagnostic testing, the widespread adoption of advanced molecular diagnostic technologies, the growth in point-of-care testing, and continuous innovations in diagnostic instruments and assays. Additionally, the aging population, the expansion of laboratory infrastructure, and regulatory support are further accelerating market expansion.

KEY TAKEAWAYS

-

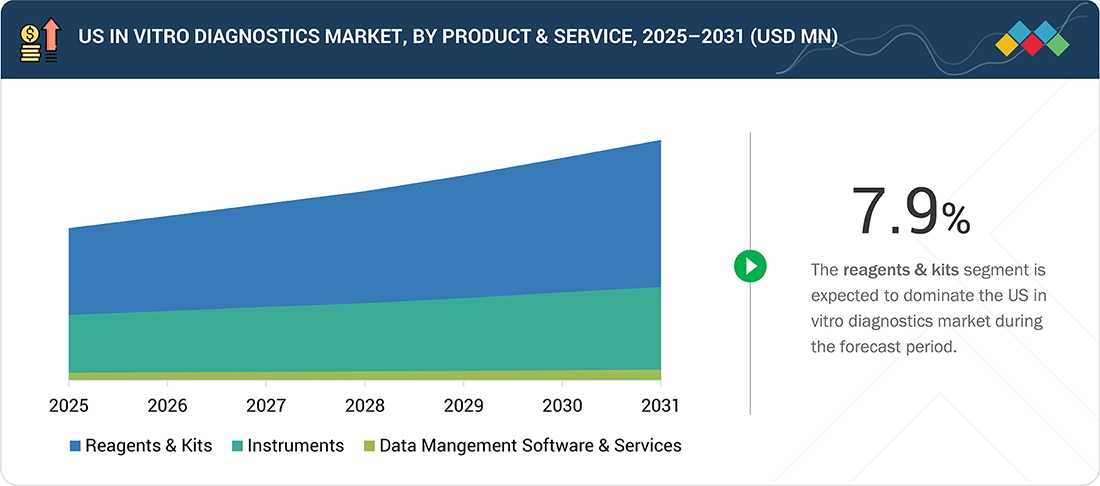

By Product & ServiceBy product & service, the reagents & kits segment is expected to register the highest CAGR of 7.9% during the forecast period.

-

By TechnologyBy technology, the immunoassays segment accounted for the largest share of 33.5% in 2025.

-

By SpecimenBy specimen, the blood, serum, and plasma specimens segment is expected to dominate the market, growing at the highest CAGR of 7.9%.

-

By Site of TestingBy site of testing, the point-of-care testing segment is projected to grow at the highest rate from 2026 to 2031.

-

By ApplicationBy application, the infectious diseases segment is expected to dominate the market in 2025.

-

By End UserBy end user, the clinical laboratories segment is expected to register the highest CAGR during the forecast period.

-

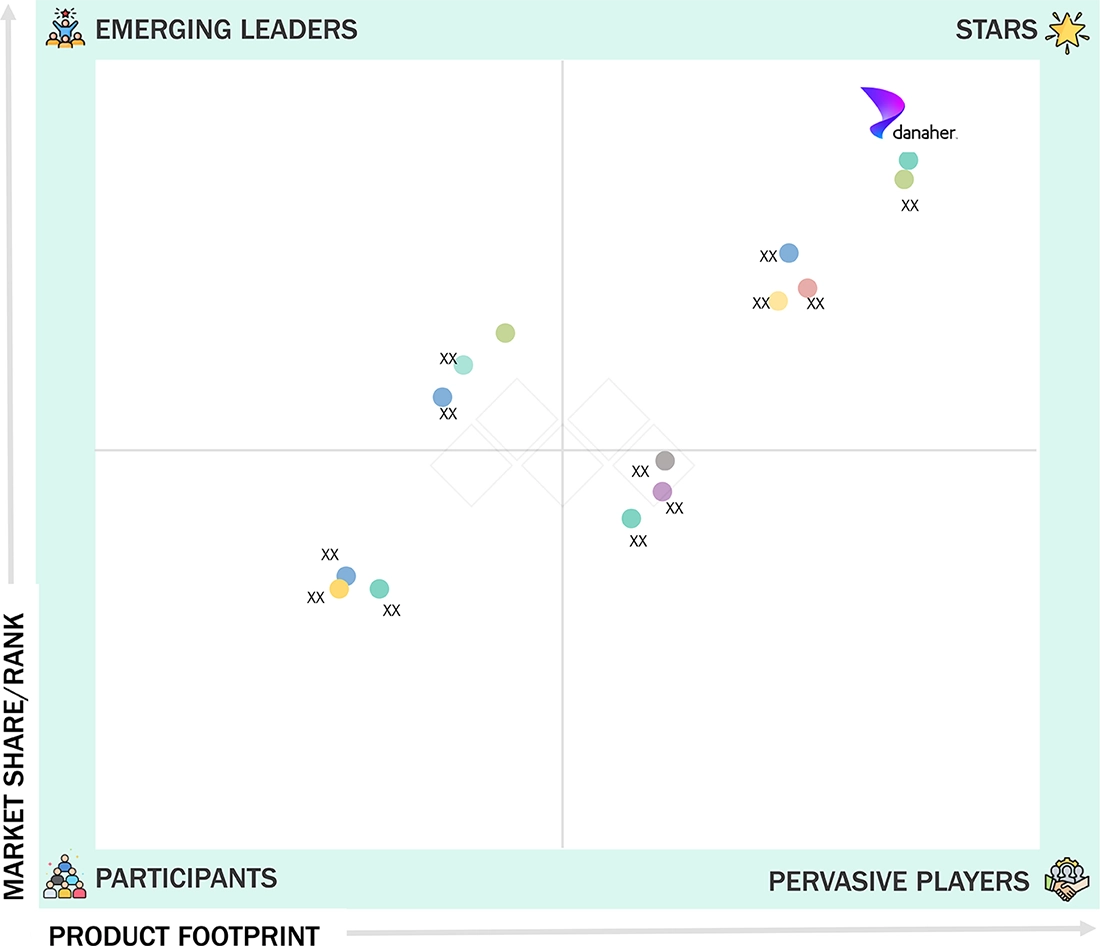

Competitive LandscapeDanaher Corporation, F. Hoffmann-La Roche Ltd., and Abbott Laboratories were identified as the star players in the US IVD market, supported by their strong market presence and extensive product portfolios.

-

Competitive LandscapeDevyser (Sweden) and Boster Biological Technology (US) have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas.

in vitro diagnostics market in US is experiencing steady expansion, driven by the increasing need for accurate, rapid, and high-throughput diagnostic testing to support early disease detection, personalized medicine, and effective patient management. Growing test volumes across hospitals & clinics, clinical laboratories, and point-of-care settings, together with rising adoption of molecular diagnostics and automated platforms, are strengthening market demand. Ongoing collaborations between diagnostic companies and healthcare providers, along with continuous investments in assay development and laboratory automation, are further reshaping the competitive landscape and supporting long-term market growth.

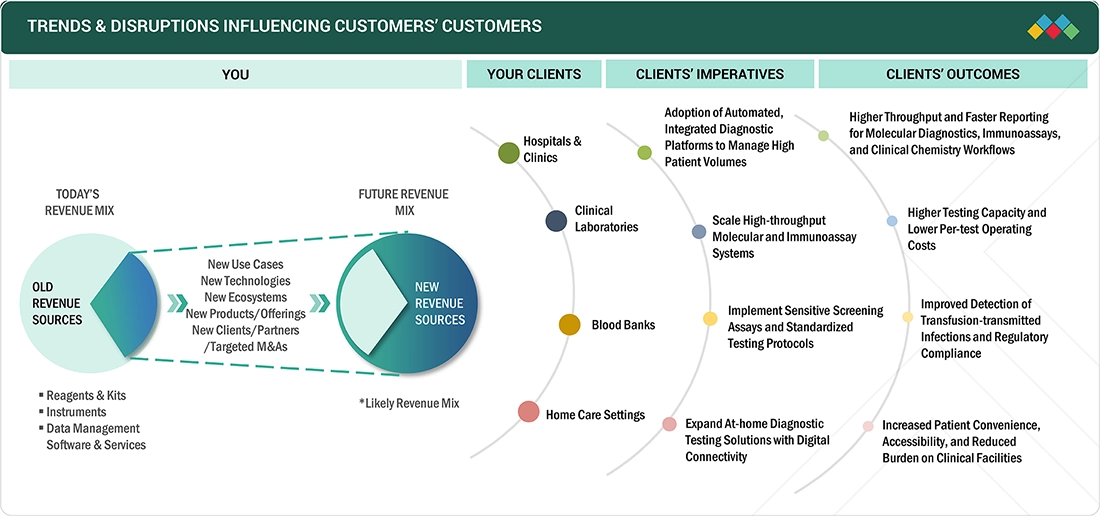

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The US in vitro diagnostics market is expected to witness steady growth, supported by the rising burden of infectious diseases and the increasing need for accurate and timely diagnostic testing. Point-of-care molecular diagnostics represents an under-penetrated opportunity for several OEMs, creating scope for future expansion. Continuous innovation is driving the development of advanced diagnostic applications. Technologies such as next-generation sequencing (NGS) enable multi-gene testing, improve tumor profiling, and support personalized treatment selection. These advancements facilitate the detection of actionable mutations and rare genetic alterations, enhancing clinical decision-making. The ongoing shift toward molecular and genomic diagnostics is expected to reshape revenue distribution across the US IVD market over the next few years.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing geriatric population and subsequent rise in chronic diseases

-

Emergence of rapid PoC technologies and rising adoption of automated analyzers

Level

-

Stringent regulatory requirements

-

High cost of diagnostic equipment

Level

-

Introduction of disease-specific biomarkers and tests

-

Increasing significance of companion diagnostics

Level

-

Operational barriers

-

Data privacy and cybersecurity risks

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing geriatric population and subsequent rise in chronic diseases

The expanding geriatric population in the US is significantly contributing to increased demand for in vitro diagnostic testing, as older adults have a higher prevalence of chronic conditions such as diabetes, cardiovascular diseases, cancer, and respiratory disorders. This trend is driving higher testing volumes for routine screening, disease monitoring, and early detection, thereby supporting sustained growth across hospitals & clinics, clinical laboratories, and other healthcare settings.

Restraint: High cost of diagnostic equipment

The high capital investment required for advanced diagnostic platforms, including molecular analyzers, automation systems, and high-throughput instruments, remains a major barrier to adoption, particularly for small and mid-sized laboratories. Additional expenses related to maintenance, consumables, quality compliance, and skilled workforce further increase the overall cost burden, limiting timely technology upgrades and broader market penetration.

Opportunity: Introduction of disease-specific biomarkers and tests

The increasing availability of disease-specific biomarkers and companion diagnostics presents strong growth opportunities within the US IVD market. These advancements enhance early and accurate detection, support personalized treatment decisions, and improve disease stratification, especially in high-burden areas such as oncology, cardiology, and neurodegenerative disorders, thereby driving demand for advanced immunoassay, molecular, and other testing solutions.

Challenge: Operational barriers

Operational challenges, including complex regulatory approval processes, reimbursement variability, laboratory staffing shortages, and workflow integration issues, continue to impact market efficiency. Additionally, the need for continuous system validation, compliance documentation, and IT integration adds operational complexity, which can delay the implementation and scaling of advanced diagnostic technologies across healthcare facilities.

US In Vitro Diagnostics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Utilizes GeneXpert systems for fast, cartridge-based molecular testing in decentralized and point-of-care environments. | Delivers rapid results with minimal hands-on time, provides an extensive infectious disease test menu, offers high analytical sensitivity, and supports testing in low-resource or near-patient settings. |

|

Employs cobas 4800 and cobas 5800/6800/8800 molecular platforms for high-throughput viral load testing in centralized clinical laboratories. | Ensures high analytical accuracy, automated large-volume workflows, reduced turnaround times, and regulatory-compliant performance for large-scale infectious disease testing. |

|

Deploys Alinity m analyzers for automated molecular detection of HIV, HBV, and HCV in medium- to high-throughput diagnostic laboratories. | Enables faster sample-to-result processing, minimizes manual intervention, delivers consistent assay performance, and improves overall laboratory workflow efficiency. |

|

Applies the Atellica CI Analyzer for integrated clinical chemistry and immunoassay testing in hospital laboratory settings. | Improves operational efficiency, shortens turnaround times, streamlines sample handling, and offers flexible scalability to support medium-throughput laboratories. |

|

Utilizes Applied Biosystem’s real-time PCR systems and integrated molecular diagnostic workflows for infectious disease testing. | Provides high analytical sensitivity, streamlined sample-to-result workflows, reliable test performance, and scalable throughput to support routine and large-volume diagnostic testing. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

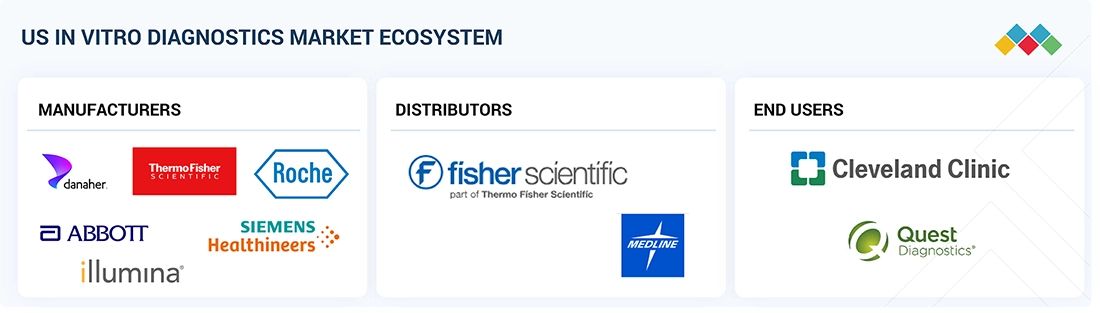

MARKET ECOSYSTEM

The ecosystem market map of the US in vitro diagnostics market comprises the elements present in this market and defines these elements by demonstrating the bodies involved. It includes products & services used in the field, technologies employed, specimens, testing sites, application areas, and end users. Manufacturers of diagnostic products include organizations involved in research, product development, optimization, and commercialization. Distributors comprise third-party channels and e-commerce platforms associated with organizations for the marketing and distribution of IVD products. Research and product development include in-house research facilities, contract research organizations, and contract development & manufacturing organizations that provide outsourced development and manufacturing services to manufacturers. End users adopt IVD products and services across various stages of diagnosis, and these end customers represent key stakeholders in the supply chain of the US IVD market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

US In Vitro Diagnostics Market, By Product & Service

In 2025, the reagents & kits segment represented the largest share of the US IVD market and is expected to maintain its leading position during the forecast period. This is primarily attributed to their continuous consumption across routine and specialized diagnostic workflows, including molecular diagnostics, immunoassays, and clinical chemistry. Increasing test volumes, growing laboratory automation, and expanded disease screening programs continue to drive consistent demand across hospitals and centralized laboratories.

US In Vitro Diagnostics Market, By Technology

The immunoassays segment retains a dominant role in the US IVD market due to its broad clinical applicability in infectious disease testing, endocrinology, oncology, and chronic disease management. High analytical sensitivity, rapid turnaround times, and seamless integration with automated high-throughput platforms have made immunoassays essential tools in clinical diagnostics.

US In Vitro Diagnostics Market, By Specimen

Blood, serum, and plasma specimens remained the most commonly utilized specimen types in the US IVD market in 2025, owing to their versatility and compatibility with a wide range of diagnostic modalities, including molecular diagnostics, immunoassays, and clinical chemistry testing. These specimen types are integral to the detection of infectious diseases, metabolic conditions, and oncology biomarkers.

US In Vitro Diagnostics Market, By Site of Testing

In 2025, the laboratory testing segment dominated the US IVD market, supported by mature laboratory infrastructure, advanced analytical capabilities, and strong demand for both routine and complex diagnostic services. Centralized laboratories continue to depend on automated analyzers, high-throughput systems, and integrated workflow solutions to ensure consistent accuracy and fast turnaround times. Growing test complexity, the rising burden of chronic diseases, and the need for standardized clinical decision support further reinforce the dominance of centralized laboratory testing.

US In Vitro Diagnostics Market, By Application

The infectious diseases segment dominated the US IVD market in 2025, driven by sustained global efforts for large-scale screening, diagnosis, and monitoring of viral and bacterial infections. High testing volumes for HIV, HBV, HCV, tuberculosis, and respiratory pathogens, combined with periodic outbreaks of emerging diseases, have accelerated the adoption of molecular diagnostics and immunoassays.

US In Vitro Diagnostics Market, By End User

Hospitals & clinics dominated the end-user segment of the US IVD market in 2025 due to high patient flows, comprehensive testing needs, and integration of advanced diagnostic platforms within routine clinical operations. These facilities rely heavily on molecular and immunoassay analyzers and rapid testing systems to support emergency care, inpatient diagnostics, and chronic disease management. Increasing automation and a focus on improving testing efficiency further strengthen the dominant position of hospitals & clinics within the US IVD market.

US In Vitro Diagnostics Market: COMPANY EVALUATION MATRIX

Danaher Corporation (US) (Star) is a leading player in the US in vitro diagnostics market, supported by its broad and integrated portfolio across clinical chemistry, immunoassays, molecular diagnostics, microbiology, and hematology platforms. Its extensive manufacturing, service, and distribution network across the US enables efficient system deployment, dependable technical support, and consistent reagent supply, strengthening its strong presence and sustained leadership in the market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 37.43 Billion |

| Market Forecast in 2031 (Value) | USD 57.18 Billion |

| Growth Rate | CAGR of 7.3% from 2026–2031 |

| Years Considered | 2024–2031 |

| Base Year | 2024 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

WHAT IS IN IT FOR YOU: US In Vitro Diagnostics Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Product matrix, which provides a detailed comparison of the product portfolio of each company in the US in vitro diagnostics market | Enables easy comparison of competitors’ offerings, helping identify gaps, overlaps, and opportunities for differentiation. |

| Company Information | Additional five company profiles of players operating in the US in vitro diagnostics market | Provides insights into competitors’ strategies, innovation focus, and partnerships, supporting strategic planning. |

| Geographic Analysis | Additional country-level analysis of the US in vitro diagnostics market | Guides market entry, localization, and targeted launch strategies by highlighting regional demand and opportunities. |

RECENT DEVELOPMENTS

- August 2025 : Thermo Fisher Scientific Inc.(US) opened a new, innovative Manufacturing Center of Excellence in Mebane, NC. The 375,000-square-foot, carbon-neutral facility is capable of producing a minimum of 40 million laboratory pipette tips each week.

- March 2025 : Danaher (US) received 510(k) clearance for the DxC 500i Clinical Analyzer, an integrated clinical chemistry and immunoassay system.

- February 2025 : Hologic, Inc. (US) received CE marking for its Affirm Contrast Biopsy Software, which integrates contrast-enhanced imaging with precise lesion targeting to improve workflow efficiency and expedite biopsy procedures.

- November 2024 : F. Hoffmann-La Roche Ltd. (Switzerland) entered into a definitive merger agreement to acquire Poseida Therapeutics, Inc. (US), a publicly traded clinical-stage biopharmaceutical company specializing in donor-derived CAR-T cell therapies, thereby strengthening its cell & gene therapy portfolio.

Table of Contents

Methodology

This study involved the extensive use of primary and secondary sources. A comprehensive study was conducted using secondary research methods to gather data about the market, its parent market, and its peer markets. The next stage involved conducting primary research to confirm these conclusions and assumptions and sizing with industry experts throughout the value chain. A combination of top-down and bottom-up methods was used to assess the overall market size. The market sizes of segments and subsegments were then estimated using data triangulation techniques and market breakdown.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, investor presentations, SEC filings of companies and publications from government sources [such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), International Trade Administration (ITA), American Association for Clinical Chemistry (AACC), American Diabetes Association (ADA), Association for Molecular Pathology (AMP) and Centers for Medicare and Medicaid Services (CMS) were referred to identify and collect information for the in vitro diagnostics market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the in vitro diagnostics market. The primary sources from the demand side include hospitals & clinics, clinical laboratories, blood banks, pharmaceutical and biotechnology companies, and academic institutes. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

Market Size Estimation

For the market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the in vitro diagnostics market. All the major product manufacturers were identified at the country/regional level. Revenue mapping for the respective business segments/subsegments was done for the major players. The in vitro diagnostics market was split into various segments and sub-segments based on:

- List of major players operating in the products market at the regional and/or country level.

- Product mapping of various in vitro diagnostics manufacturers at the regional and/or country level.

- Mapping of annual revenue generated by listed major players from in vitro diagnostics (or the nearest reported business unit/product category).

- Extrapolation of the revenue mapping of the listed major players to derive the market value of the respective segments/subsegments.

- Summation of the market value of all segments/subsegments to arrive at the in vitro diagnostics market.

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Market Size Estimation (Bottom-up Approach & Top-down Approach)

Data Triangulation

After arriving at the overall size of the in vitro diagnostics market through the above-mentioned methodology, this market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. Examining several macro variables and regional trends from demand- and supply-side players helped triangulate the extrapolated market data.

Market Definition

IVD tests are non-invasive tests performed to diagnose, monitor, screen, and assess diseases and health conditions. The term "in vitro," which refers to "in glass," signifies that test tubes or petri dishes are typically used in these tests. These tests are performed artificially on biological samples (blood, urine, and tissues). US IVD has a broad scope ranging from sophisticated technologies performed in clinical laboratories to simple and easy-to-use rapid testing kits.

IVD is used to assess a person's health. This technique is used in precision medicine to determine the suitable course of treatment for particular patients and diagnose and prevent diseases and other medical disorders.

Stakeholders

- Transfection products manufacturing companies

- Pharmaceutical & Biopharmaceutical Companies

- Chemical Companies

- Biopharmaceutical Companies

- Contract Research Organizations (CROs)

- Contract Development and Manufacturing Organizations (CDMOs)

- Research Institutes and Universities

- Venture Capitalists & Investors

- Government Associations

Report Objectives

- To define, describe, and forecast the US in vitro diagnostics (polyhydroxyalkanoate-(pha)-market) market based on product & service, technology, specimen, site of testing, application, end user, and region.

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and industry-specific challenges).

- To assess the in vitro diagnostics market with respect to Porter’s Five Forces, regulatory landscape, the value chain, the supply chain, ecosystem analysis, patent protection, pricing assessment, key stakeholders, and buying criteria.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the US IVD market for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of the US IVD market in six primary regions (along with countries)—North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa, and the GCC Countries.

- To profile the key players operating in the US IVD market and comprehensively analyze their core competencies and market shares.

- To track and analyze competitive developments such as partnerships, agreements, collaborations, acquisitions, expansions, product/technology developments, and product approvals.

- To benchmark players within the US IVD market using the Company Evaluation Quadrant framework, which analyzes market players on various parameters within categories of business strategies, market share, and product offerings.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the US In Vitro Diagnostics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in US In Vitro Diagnostics Market